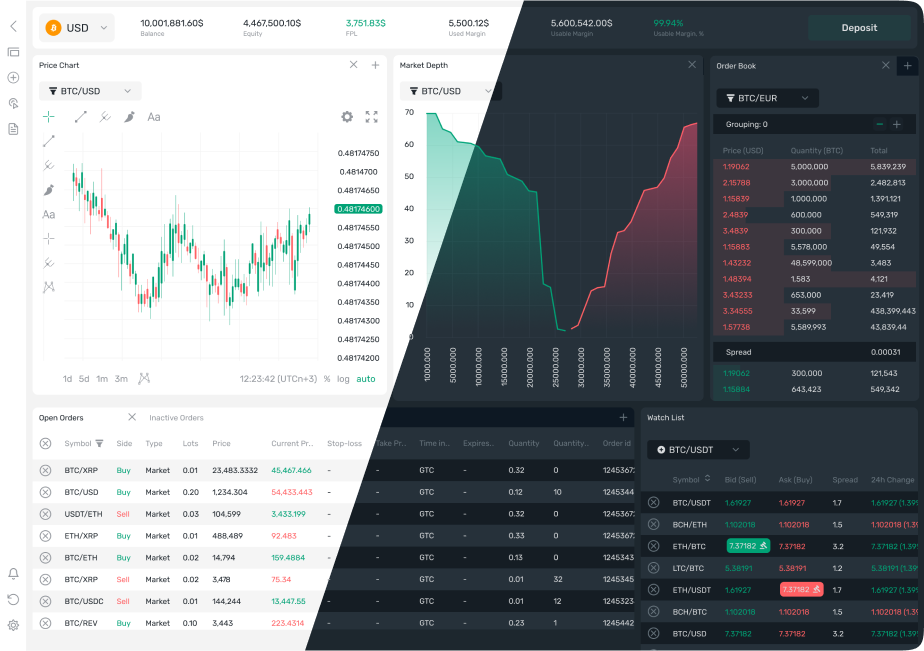

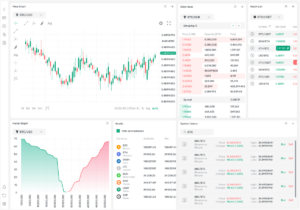

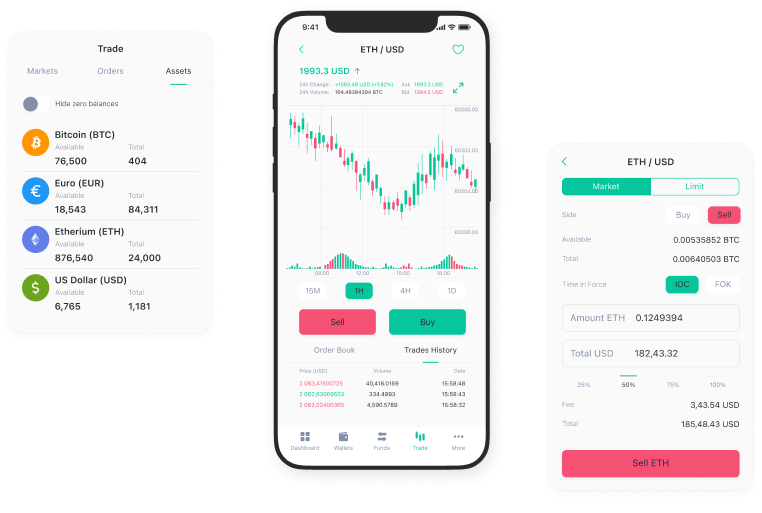

- Workspaces for different styles of trading

- Suitable for placing several orders at once

- Monitoring of real-time activity

- Balance display in the context of currencies

- The equivalent of every user’s currencies in USD

- Separate monitoring of locked balance