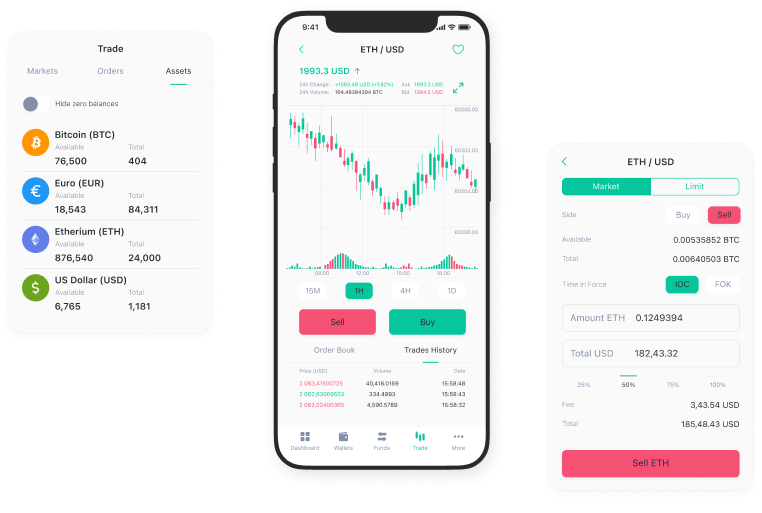

We make sure that limit orders reach the LP even in case of temporary technical issues. Your trading obligations are prioritized, intelligently resending specific limit orders like ‘Good till cancel,’ ‘Good till date,’ and ‘Day’ types during network issues, while strategically avoiding market order resends to safeguard your traders’ price expectations from market shifts.

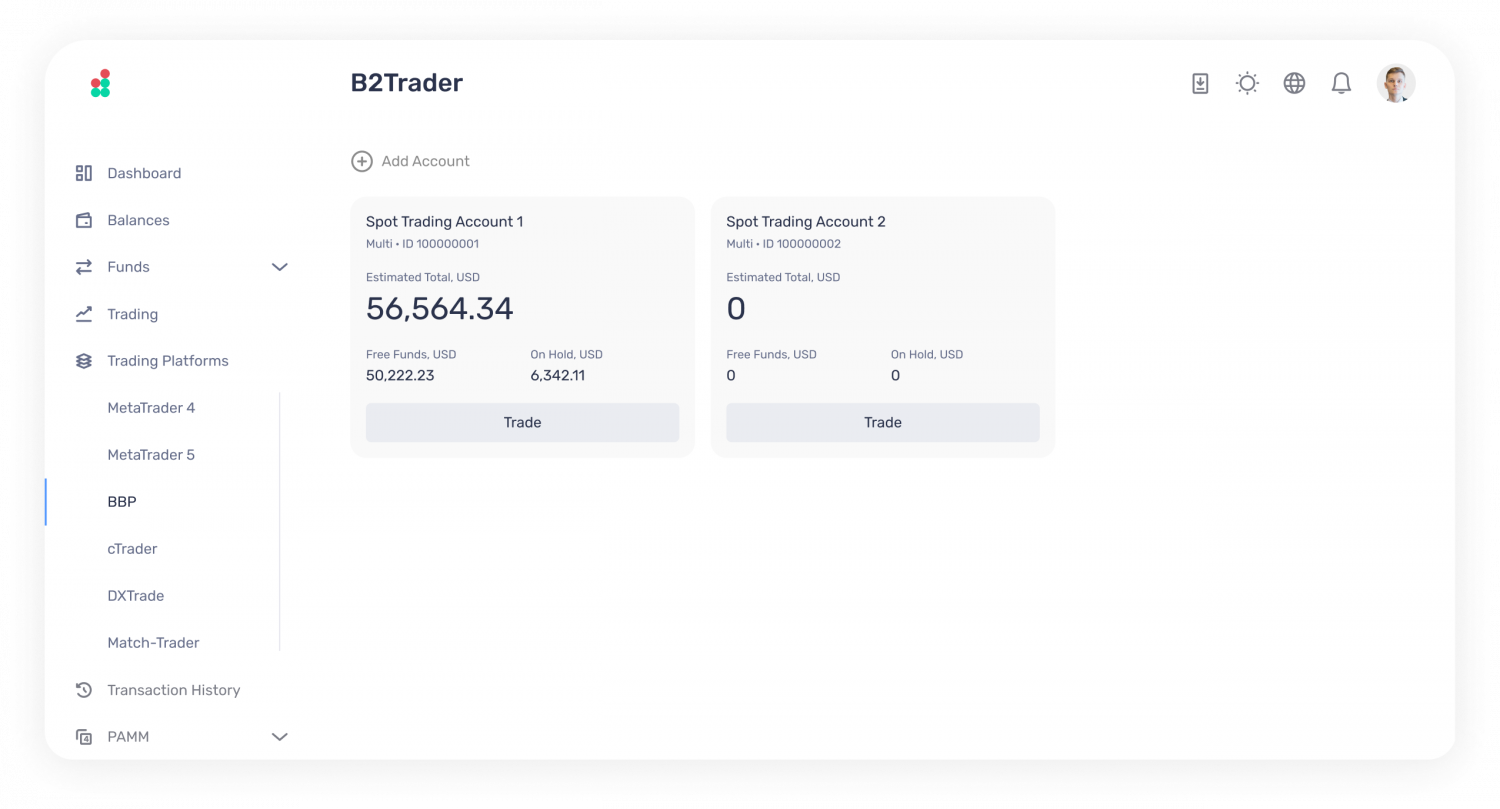

B2Trader